I came across an interesting paper on the website of the Harvard Kennedy School’s Belfer Center for Science and International Affairs that I think is worth picking apart in some detail. It bears the title “Toward Equitable Ownership and Governance in the Digital Public Sphere,” and it is a wonderfully clear example of that old idiom: “if all you have is a hammer, everything looks like a nail.” In this particular case we have a group of academics bearing a hammer labeled “DAO tooling” coming after co-ops with an unsettling gleam in their eyes.

DAO is an acronym meaning Distributed Autonomous Organization, and it comes to us from the cursed world of cryptocurrency (if that fact is new to you, you might want to stop reading this right now and go read this first, lest what follows be utterly incomprehensible). The authors admit that there is no agreed upon definition of a DAO, but for our purposes that doesn’t really matter. What matters is their suggestions for how co-ops can use “DAO tooling” to increase their growth and competitiveness. These suggestions are, without exception, terrible. The reason for that is not necessarily the suggestions themselves, but the repeated emphasis on using cryptocurrency smart-contracts to implement them. To give you a taste, this is from the Executive Summary:

This paper explores how newly developed DAO tooling could help co-ops compete in the online economy. Specifically, we outline how DAO tooling could provide co-ops with:

Effective Voting—DAOs test novel and varied governance systems that appear to offer some unique benefits not available to legacy organizations. These include systems such as reputation-weighted voting, holographic consensus, conviction voting, and quadratic voting.

Increased Member Engagement—DAO tooling allows organizations to gamify milestones for their members, autonomously tracking the progress of members toward their goals, and rewarding them based on behavior. This encourages members to stay on task both for short-term gain and to develop a strong reputation in the long term.

Here we have two common issues that cooperators do spend a good bit of time discussing, debating, and experimenting on. The proposed solutions, however, are way off the mark. For instance, while it may actually be the case that any of the alternative voting schemes mentioned may be better suited to purpose than whatever decision-making proceedure a co-op already has in place, there is no need to make use of a blockchain to accomplish any of them. While it may be possible to implement these voting schemes on the Ethereum blockchain, that doesn’t mean the Etherereum blockchain is necessary, or even useful, in doing so. And here I'll mention a fundamental aspect of DAOs that the authors don't discuss, and that rarely gets mentioned by crypto advocates: the “gas fees” that must be paid any time the DAO interacts with the blockchain ledger. Here’s a description of how they work (because it’s crypto nonsense, you know it’s going to be needlessly complicated):

Gas price is the amount of ether (ETH) that a user is willing to pay for each unit of gas, measured in gwei (1 gwei = 0.000000001 ETH). The higher the gas price, the faster the transaction or smart contract will be confirmed, but also the more expensive it will be. The lower the gas price, the slower the confirmation, but also the cheaper it will be. Choosing the right gas price depends on the urgency and importance of the transaction or smart contract. A DAO can use tools such as gas trackers, gas estimators, and gas limit calculators to find the optimal gas price for its smart contract, based on the current network conditions and the expected execution time. [emphasis added]

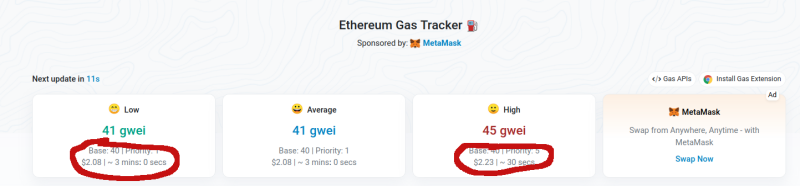

Imagine running a governance system where your co-op was charged money every time someone cast a vote. Why would anyone ever do that? They wouldn’t, of course, which is why I’m not terribly worried that this will catch on with co-ops anytime soon. Because while crypto advocates try to obscure the price of fees by quoting everything in their made up “currencies,” a quick conversion shows the network’s cut to be quite high in dollar terms, not to mention their abysmal wait times.

So making a change to the ETH blockchain (which, remember, is how DAOs function) currently costs a minimum of $2.08, and you’ll have to wait around 3 minutes for the changes to take place (the price went up to over $3 while I was writing this). Meanwhile, I can make a change in a shared Google Docs spreadsheet and it doesn’t cost me anything at all and happens instantly, and Google keeps a record of the change that everyone can see.1

Next, the authors tackle the eternal bugbear of member engagement. Here they offer DAOs as a way to “gamify” participation which is another thing that can be done perfectly well without involving the blockchain and its associated gas fees. Rather tellingly, in the full paper the only example they give of this is Mochi, a Slack and Discord bot combined with a smart contract that automatically takes money out of your Ether wallet if you or your friends fail to post a daily affirmation. It is incredibly dumb and seems like a really good way to ruin friendships. Fortunately, the website currently only lists five users, which is actually rather high, if you think about it.

The next problem the authors claim to have a “DAO tooling” solution for is “Predictable Compensation/Patronage.” The problem here is that I don’t think this is an actual problem. The authors themselves provide no evidence that it is, simply stating that have problems determining pay rates with no reference or example provided.

Co-ops often have issues determining how much each member should be compensated for their work. Distributions to members of a co-op are proportional to their labor, efforts, and success in using the co-op, also known as “patronage.” The more a member patronizes a co-op, the more services that member receives, and/or the more of a co-op’s earnings are allocated to that member (Walden and Spelliscy, 2020).

That citation at the end, that one might assume would support their contention of this being a real problem, instead leads to a 2020 post about how DAO founders can use co-op structures to avoid securities regulations (which is, I believe, the main reason DAO people are taking an interest in co-ops in the first place). Their example of "DAO" tooling in this sphere is something called "Coordinape" which is just a system for showing appreciation among co-workers. As the authors describe it:

Coordinape...allows members of an organization to allocate tokens, called GIVE, to other members of the organization in recognition of value creation, providing insight into compensation decisions.

Assuming that some type of tokenized recognition system would be of benefit to a co-op or co-op network, why involve a blockchain? Like most of the solutions the authors propose, this one would be better accomplished in a way that doesn't involve paying gas fees and meddling with tokens that may or may not be considered unregulated securities.

Next we come to “Transparency and Accountability” where once again we have the recognition of a legitimate issue combined with a frankly bizzare suggestion for a solution.

...on-chain DAO activity like token voting, treasury management, and the payment of salaries and subsidies for public goods can be recorded on an immutable public ledger viewable by anyone with an internet connection.

I know of very few businesses – none, if fact – that would be amenable to having their books viewable by literally anyone with internet access. One has to wonder exactly which co-ops the authors consulted in conceiving of this “fix.” And once again, there is already a well-understood and widely utilized solution for creating transparency in managing budgets, salaries, and the like: it’s called “open book accounting.” And remember, since all “on-chain DAO activity” comes with gas fees, this suggestion amounts to, “hey, why don’t you pay to make sure everyone, not just your members, can dig through your books.” It’s bizarre, frankly, and points once more to the whole issue of hammers and nails that runs throughout this paper.

The next non-nail that the authors attack with their DAO hammer is “member accountability.” They write:

A user’s reputation can automatically change based on the quality and quantity of contributions to a community. Reputation can be non-transferable, tied to a particular individual or organization, and recorded on an immutable public record. These measures can make accountability in a DAO easier to maintain than in a traditional co-op, where it may be hard to identify rule-breakers and hard to enforce accountability as the organization grows.

Again, here the authors have identified a relevant issue and offered a very bad solution for it. All organizations have to deal with accountability, and it is a surety that accountability mechanisms and systems could be improved in some co-ops; but adopting a system that makes accountability issues – which are personnel issues – public to everyone on the internet is not only a very cold and mechanical way of addressing the issue, but it might also have a hard time getting by the legal department, for the same reasons that most companies keep personnel records confidential. And that word “immutable” is especially problematic in this context, as being immune to change here simply means everything everyone does will go on their permanent record (which will be publicly visible to literally everyone). I could riff here on god complexes and the dystopian uses to which such systems could be put, but fortunately the suggestions are so impractical that I don’t think I need to bother.

The final issue the authors address is another perennial one: how to provide more outside financing for co-op development.

Co-ops are at a significant disadvantage to corporations when raising the funds necessary to scale and compete. They can generally only raise capital by direct contributions through membership fees, by agreement with members to withhold a portion of net income based on patronage, or through retention of a portion of sales proceeds for each unit of product marketed (Walden and Spelliscy, 2020).

The authors are either unaware of existing co-op funding mechanisms like CDFIs, regional loan funds, and preferred shares (which seems unlikely) or they have made a conscious decision to not mention the existence of a large part of the co-op funding landscape in their paper. Why would they make such a decision? You would have to ask the authors to be sure, but I would guess it might be because including them highlights how unnecessary “DAO tooling” is in this area. Which is not to say that we couldn’t use more funding, and more varieties of funding, for co-op formation – we could – but what the authors are selling ain’t it. And they admit as much, themselves, before suggesting some more bad ideas from the DAO toolbox.

While securities laws and lack of legal clarity make it difficult or impossible to reliably use blockchain tools for fundraising, particularly in the United States, DAOs have started experimenting with alternative forms of funding which could ultimately be relevant to co-ops. These include selling or airdropping tokens to bootstrap treasuries.

If someone can explain to me the difference between "using blockchain tools for fundraising" and "selling tokens" I would love to hear it. They are, of course, one and the same thing, and as they mention, securities laws don't necessarily look too kindly on the practice. Just consider: their big idea for helping co-ops raise money is for those co-ops to sell unregulated securities. The mind boggles.

This is where I’ll remind you that this paper bears the imprimatur of Harvard University. If it didn’t I probably wouldn’t bother dissecting it as I’ve done here. It would just be another paper by another written by a group of academics with Silicon Valley stars in their eyes. The web is full of them. But coming with the imprint of an “elite” university lends a certain credibility, and may therefore make these suggestions seem plausible to those without enough prior knowledge to see through the smoke. For that reason, I’ve taken the time to go through just some of the howlers in this paper and explain why that’s exactly what they are. I hope at some point this fad passes entirely, and its promoters move on to other obsessions, but until then I’ll have to keep writing these occasional missives, as I don’t see many other people in the co-op movement saying anything critical about this stuff.

And we need to be critical of it. If we are not, not only will poorly thought out solutions to co-op problems get given a credence they in no way deserve, but those solutions that are already here in existence – getting along quite well without any need at all for DAO tooling or blockchain anything – will end up being erased, or at least downplayed.

The paper provides a perfect example of this in claiming that cooperatively owned Mastodon instances would make a good fit for their DAO solutionism. They mention Social.coop, which is a cooperatively-owned Mastodon instance with fully transparent accounting and decision making, that has had few problems in scaling immensely since it’s inception. I’m a member of the co-op, as is one of the authors, as is noted in the paper. Tellingly, though the authors choose to focus on blockchain solutions to problems that might occur in the future, while ignoring the blockchain-free solutions that we have actually developed to meet the problems that we’ve actually faced (which are surprisingly few, given what we’re doing). We make use of Loomio and Open Collective for decision making and accounting, already accomplishing much of what “DAO tooling” promises to deliver but at a much lower price.

And finding Social.coop mentioned here was even more irritating to me, as the overwhelming sentiment from members on both our Mastodon and Loomio discussion threads has been pretty uniformly anti-crypto. I can count on one hand the number of members I would expect to be excited by adding “DAO tooling” to our already perfectly well-functioning co-op, so to find ourselves being put forward as a candidate for this crypto-fication feels to me like a very real invisibilization of who we actually are, in the service of selling something that many of us despise2 .

If you’ve made it this far, congratulations and thank you! And if someone ever tries to sell you on joining a DAO, my suggestion is that you just back slowly away and go find yourself a nice co-op...and then send them this link.

- 1Advocates might argue that you can batch transactions to save on gas fees, but that just means using some "off-chain" mechanism to do the actual recording, which defeats the entire purpose of using a DAO in the first place.

- 2I realize that I am relying on anecdata for this assessment, and there may be more crypto enthusiasts among the membership than I am aware of...but if there are they sure keep it to themselves, which is not something crypto enthusiasts are generally noted for.

Comments

Nathan Schneider

January 24, 2024, 12:10 am

Thanks for this essay. I'm one of the authors of the report. I share a lot of your skepticism about crypto solutionism. However, I do think that there are important ways in which co-ops could benefit from digitally native infrastructures, especially as they come to operate (like Social.coop, in which we are both active members) across (and ideally indifferent to) territorial borders.

On a number of these points, I am not sure why the hostility to the digital tooling is so strong, especially when the alternative is relying on legal frameworks established and backed by military force, largely designed to support the interests of the investor class. For instance, why is it okay to sell shares of co-op stock backed by cops with guns but not digital tokens backed by cryptographic software? Why is it okay to rely on dollars that are tracked by powerful financial institutions and enabled through debt-based issuance, but not to pay transaction fees to a user-controlled network?

On the question of financing, I am quite aware of the existing co-op financial techniques, but I am also aware of their profound inadequacy for producing a co-op economy right now that is much more than marginal. That is why I am interested in cultivating alliances with emerging potential partners. I have no interest in the side of crypto that is focused on speculation and financialization. But there is also a critical mass of people in the sector who share a lot of the goals of the cooperative movement—non-extractive economies that are highly participatory and democratic. In trying to achieve those goals, these people have faced a lot of the same challenges we in co-ops have—namely, being drowned out by economic systems designed to empower investors above all. For that reason, I think there is opportunity for common cause. Not solutionism.

The point isn't that these tools will be salvific for co-ops. The point of the report is to identify a shared agenda among people working for a more democratic economy to create the public policy we all need, regardless of whether our back-end infrastructure is backed by cryptography or cops.

For more of my reflections on this issue, see here: https://cryptocarnival.wtf/schneider

Josh Davis

January 24, 2024, 4:37 pm

Thanks for taking the time to respond, Nathan, but I have to wonder if we're even engaged in the same conversation when I see you claiming that the current practice is to "sell shares of co-op stock backed by cops with guns." I assume you are referring to membership shares when you refer to "co-op stock," but I've never once heard of police being involved in recruiting cooperative members.

Apart from that, you seem to be under the impression that ethereum and other crypto tokens are a type of currency, and a possible replacement or supplement to dollars. They are not, and never will be. Because while you may not be interested in the speculative financial side of crypto, that is what most people involved in it are there for (well, that and the money laundering) and without them the system would quickly collapse. ETH will never be able to be used like a currency because the speculators will keep the price constantly fluctuating because that's how speculators make profits. And, of course, co-ops and everyone else will continue covering their expenses, their wages, their fees and taxes, etc. in boring old dollars, so even if a co-op started using "DAO tooling" they are still going to have to use money - they'll just be adding a monetary expense for registering votes or showing appreciation for their co-workers as well.

And surely you cannot be unaware that Ethereum's Proof-of-Stake system, while less environmentally devastating than Bitcoin's Proof-of-Work, leads inexorably to increasing concentrations of wealth within the network. In fact, that process is already largely complete, as David Rosenthal (who literally wrote a foundational text on blockchain technology) points out here:

As I stated in the post multiple times, I am not necessarily opposed to co-ops experimenting with some of the suggestions made, like different types of voting methods, for instance. What I am opposed to is co-ops using, and being encouraged to use, an extremely clunky, wildly expensive technology whose entire existence is premised on "performing hugely profitable illegal transactions."

To reiterate: any of the voting or accountability systems your group wrote about might be useful for some co-op but there is absolutely no reason to do it through the use of smart contracts and a DAO when you could do the same thing using a different type of blockchain (centralized, permissioned) that is 10,000 times cheaper to run. Want to try liquid voting or value tokens? Cool. Get a Raspberry Pi and hire a tech co-op with some development chops to code something up for you. Sending money to the (very few) people staking ETH every time you want to record a vote is not the way to do it.

If people who are already bought into DAOs want to try to learn from co-ops, there's nothing I can do to stop them. And, even I'll admit, it's possible a co-op could take something useful from a DAO...but using the Ethereum blockchain is not one of those things, for all of the reason I explained in the piece, and my previous one.

Matt Noyes

January 24, 2024, 8:49 pm

Great post and glad that Nathan replied. In Cooperatives at Work we quote three people we interviewed about co-ops and blockchain/distributed ledger tech, Matt Cropp, Alanna Irving, and Stacco Troncoso.

Matt was the most open to experiments with blockchain, etc., but also observed that in most co-op use cases they would be unnecessary, even if possible.

Alanna said that people doing organizational design with crypto are focused on the wrong questions. "They are excited by the parts of the problem that are quantifiable or cryptofiable and forget that the important or hard parts of the problem (building trust, connecting your vision with the outside world) aren't quantifiable at all." Luckily, she says, there is more to distributed money than cryptocurrency."

Stacco emphasized sufficiency -- use the technology only when it is really needed -- and, like Irving, the centrality of human contact. "For DisCOs," he said, "using blockchain would be ridiculous, even obscene."

That said, Solidarius.net, a transnational platform for solidarity economy exchanges of products and services operating in several countries in Latin-America as well as Italy, includes use of digital credits on a blockchain. I'm still figuring out how it all works. Here's a paper, in Portuguese, about it: https://solidarius.net/biblioteca/sis.pdf

Nathan Schneider

January 25, 2024, 3:32 pm

Thanks, Matt. Just to build on your mention of Solidarius, there are quite a number of projects out there that are exploring the intersections of co-ops and DAOs in practice. I certainly wouldn't endorse every aspect of all cases, and there have been many challenges in figuring out best practices. But here are some other examples of crypto-backed co-ops (and almost co-ops) that people can explore:

- https://songaday.world/songadao (a collective supporting people in daily creativity, Colorado LCA)

- https://www.sporkdao.org/ (which organizes the major US Ethereum conference and more, Colorado LCA)

- https://www.dorg.tech/ (a tech worker co-op, Vermont LLC I believe)

- https://www.collab.land/ (software to support DAO communities, Colorado LCA)

- https://breadchain.xyz/ (solidarity economy support co-op)

- https://opolis.co/faq/ (independent worker co-op, Colorado LCA)

You can find my collection of various folks' publications on the topic here: https://www.zotero.org/ntnsndr/collections/8TK8967U

Matt Noyes

January 25, 2024, 6:03 pm

Another aspect of this problem: in the 1980s when what was then called The Mondragon Cooperative Group (now it's the "Mondragon Corporation") adopted their Basic Principles, two stood out: Labor Sovereignty and The Instrumental and Subordinated Character of Capital. (https://www.tulankide.com/es/revista/octubre-1987). These principles marked a central struggle over which would be the organizing category, as Razeto says, capital or labor, and declared a commitment to labor and the constant need to subordinate capital. This struggle is ongoing. Ever insubordinate, Capital, and its representatives, is constantly seeking to insert itself and recover sovereignty. In the case of Mondragon, the balance of power has largely shifted in favor of capital, as seen particularly in the "coopitalist multinationals" created through acquisition and creation of capitalist subsidiaries, as Arrasti and Bretos have documented. In such cases it can be seen how the "instrument" that is supposed to solve cooperativism's problems, quickly becomes the sovereign.

As I understand it, the increasing financialization of capitalist economies has exacerbated capital's need to discover or concoct new opportunities for investment. Tokenization of assets is one such strategy. For investors, cooperatives represent a potential new field, what one writer called a "cooperative fix" to problems of valorization. But that has required changes to cooperative laws, enabling greater participation by capital in cooperatives (we think of it as co-ops accessing capital, but it's the other way around), driven by that search for a cooperative fix. The same is true of the promotion of varieties of "worker ownership" that perpetuate capital sovereignty by undermining actual workers power just like the company unions of the 1920s in the US. (See our conversation with Curt Lyon - https://geo.coop/articles/transform-finance-interview-curt-lyon) It also requires a loosening of cooperative principles, ideology, and practices.

Nathan Schneider

January 25, 2024, 9:21 pm

Matt, totally a fair concern. But I don't think it is a necessary one. Tokens can be designed in a multitude of ways. In the same way that company stock can be designed to be a speculative asset or a representation of cooperative membership—and digital tokens have even more flexibility.

The token designs that are most visible publicly are the highly speculative, financialized ones. But there are a variety of other token designs that have been actively discussed and developed around crypto, including in my work. For instance:

- "Soulbound" tokens that cannot be transferred

- Tokens that disappear over time

- Inflationary tokens that lose value over time through issuance

- Tokens that have financial rights but no governance rights

- Tokens that have governance rights but no financial rights

- Tokens that represent contributions in an internal ecosystem

- Tokens that issue royalties to the original creator with each transaction

- Tokens that pay redistributive taxes on use

In general, my interest in these technologies is the possibility of giving us more freedom to create truly people-centered value flows, and of course it always depresses me how the most visible use cases are the ones heading in the opposite direction.

Still, I've seen trends where people in the DAO world have actually been moving more toward cooperative practices—for instance, insulating governance from investor influence, and reserving certain benefits only to those who make non-financial contributions.

Add new comment