Are you a coop and getting ready to do your taxes? In this teach-in our Director of Economic Democracy, Ricardo Nuñez, and SELC Staff Attorney, Gregory Jackson, provided an introduction to the powerful way that worker cooperatives equitably distribute wealth and why it matters for your cooperative’s taxes! They covered:

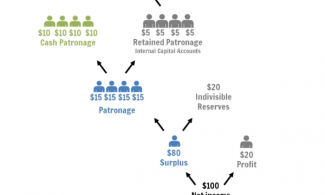

✅ How does money flow through a cooperative business?

✅ What are some of the tax and accounting issues in a cooperative?

✅ What cooperative specific tax benefits exist and how can your cooperative take advantage of them?

Find more information and resources on the SELC website.

p.s. Sometimes our presenters speak slowly to account for ASL interpretation. Feel free to change the Playback Speed found in the Settings icon.

Presentation Slide Deck

Add new comment