Unit I, Unit II, Unit III, Unit IV, Unit VI, Unit VII

[Translator's note: In the previous Unit the solidarity group did the crucial but sometimes neglected work of analyzing the productive factors that each member can contribute to the solidarity enterprise. Whereas in capitalist firms productive factors are typically bought on the market, in solidarity enterprises the members themselves are the first source of factors, not just labor, but materials, technology, management, and of course solidarity, the C Factor. What about financing, “the most scarce of the factors of production, and usually the most difficult to obtain?" In this Unit the solidarity group tackles this common problem for cooperatives, breaking down and researching the various possible sources of external financing: loans, investments, donations, and solidarity funding. Which are most efficient? Which are most aligned with the logic of solidarity economy? The Unit ends with the solidarity group preparing a Cost Budget and making a Financial Plan which details the types of financing to be sought and on what terms. – Matt Noyes]

UNIT V

EXTERNAL FINANCING

Loans, Grants, Donations, and Solidarity Funding

Session 9

Plan

-

Gather, welcome, ice-breaker, form a circle, choose a moderator for the meeting.

-

Evaluation of Unit IV.

-

Each participant reads aloud their answers to the individual evaluation form from Unit IV.

-

Carry out the group evaluation as described in the group evaluation form from Unit IV.

-

-

Break, snack.

-

“Reading Five.” (One or two people read out loud as others follow along in the text.)

-

Questions for review and discussion. (Participants volunteer to answer one question each, raising their hands to speak. Other participants can add to their answers but it is best if nobody speaks twice before others have had a chance to speak.)

-

Questions for the facilitator, exchange of ideas and free conversation on the theme.

-

Suggestions for the Individual Task. (The facilitator will explain the content and purpose of the individual task, clarifying any issues and answering questions that come up.)

READING FIVE

Where do we stand? A group of people are united around clear objectives, ready to create an enterprise, based on a very precise and well-defined business idea.

They have precisely identified the factors needed for its creation and efficient operation.

They know which of the necessary factors will be contributed by members and which they can develop together as a group.

What we need to study and analyze now is how to obtain the remaining factors of production. This brings us to the important question of financing and its different forms and modalities.

Factors we do not have and can not create ourselves have to be obtained from third parties, people or economic agents who have them. Now, we saw in Reading Three that of the six factors of production it is through financing that the enterprise establishes economic relations with others, including with providers of the inputs we still need. In other words, in order for the enterprise to obtain the other factors it needs it must secure financing, which is indispensable. Like other factors, finance has to be obtained from others if the enterprise does not have it in sufficient quantity. We need, then, to examine the ways to obtain external financing for a solidarity enterprise.

Obtaining Financing in the Market

It is commonly said that in addition to the capital provided by their founders, there are three ways for enterprises to obtain financing in the market: 1) issuing shares which represent a defined proportion of the enterprise; 2) issuing bonds, or promises to pay a certain amount at a defined date in the future, to be purchased by third parties at a lower price than the nominal value; and 3) securing loans from banks or other financial firms.

It is necessary to carefully examine what these three forms of financing mean to a solidarity enterprise, to see how and to what degree each is possible for the enterprise the group means to create, and to analyze each in order to determine if it is appropriate or not.

1. Issuance and Placement of Shares

Given that capitalist businesses typically take the form of corporations owned by shareholders, many people believe that it is impermissible for solidarity enterprises to issue shares or adopt any kind of stock-holding system. This is based on a misunderstanding. In reality, shares are only a mode of representation of the value of an enterprise divided into smaller units which are assigned to the various members in proportion to the contributions they have made to the enterprise.

A corporation or joint-stock company is “capitalist” if the only contributions that are valued and confer on their owners a degree of ownership of the enterprise are financial contributions, and if, moreover, the percentages of ownership represented by shares are bought and sold in the market, such that ownership of the enterprise is separated from those who work and participate in it.

But a company that issues shares is not capitalist when the shares that represent the value of the enterprise also recognize the other factor contributions made by members, for example, labor, technology, management, etc., and if the shares are not sold on the market, thus ensuring that ownership of the enterprise remains in the hands of the solidarity group that created and organized it.

This being the case, it is clear that if the enterprise issued shares in order to finance its efforts through the contributions of third parties, that is to obtain external financing, it would be running the risk of converting itself into a capitalist enterprise, because it would in fact be transferring part of the ownership to parties outside the solidarity group; and, as ownership of the enterprise confers rights to the profits it generates, the workers and group members would begin to work for those external financiers and owners.1

2. Issuance and Sale of Bonds

The second usual way of obtaining external financing consists of the enterprise issuing and selling bonds, that is, documents representing a specific quantity of money that the enterprise promises to redeem on specific dates and which are offered and sold at a discount, that is at a price lower than that which the enterprise promises to pay on the maturity date.

The issuance of bonds does not affect the ownership of the enterprise, and in that sense does not open the possibility of the solidarity enterprise assuming a capitalist form. Nonetheless, bonds compromise future profits since the obligations assumed by the enterprise have to be paid out of the revenue generated by its operations; and in the event that the enterprise is not in a position to redeem the bonds, it would have to declare bankruptcy and use its equity to meet its financial obligations.

The other problem is that bonds constitute a very expensive form of financing that impinges on the enterprise’s ability to operate with a coherent logic of solidarity. This is because bonds do not confer rights over property or management of the enterprise, so those who buy them are only inclined to do so if the discount on the face value of the bonds is great enough to outweigh the cost of immobilizing the funds and risking their loss. In practice, this normally means that the cost paid for financing obtained in this way is greater than the contribution the financing makes to the profits of the enterprise, that is greater than its factor productivity. Thus it is highly probable that the workers in the solidarity group will end up working for the bondholders rather than for themselves and be forced to to operate in a way that maximizes monetary returns, which implies a deviation from the proper rationality of the solidarity economy.

3. Loans and Credit

Taking out loans is a normal way to obtain money through the market, with the money being offered for a specified time in exchange for payment of interest. Giving and receiving loans is a process of exchange, similar to any other contract or purchase and sale: an asset is paid for and received. But there are important differences to keep in mind that are crucial when it comes to evaluating the appropriateness of soliciting financing through loans and assessing opportunities when they arise.

The first difference is that in the case of loans the moment of exchange is split up: the provider of credit gives money to the borrower who does not pay at that moment but instead promises to pay at a future date. This poses an obvious risk: the borrower might not repay the lender. It is for this reason that the provider of credit requires the borrower to provide certain guarantees, which fulfill two functions: on the one hand they encourage the borrower to do all they can to make sure they can pay the money back. On the other hand, guarantees provide the lender with security: even if the borrower does not pay, the lender can recuperate their money.

The second difference is that when it comes to loans we are dealing with an exchange of money for money and what is bought and sold is really the time during which this economic asset can be used (the time that transpires between the moment when the loan is made and the moment when the money needs to be repaid). The enterprise that obtains loans will use the money as a factor of production in order to generate, in combination with the other factors, value and wealth. This productivity is what makes it possible to repay the loan with interest that is charged. It is important then for the enterprise to ensure that the productivity of the finance factor obtained through a loan is high enough to justify the borrowing. If the productivity of the factor is insufficient to cover its cost the workers and members of the enterprise will be working on behalf of the external creditor, redirecting to the creditor part of the value generated by their labor and the other factors.

So credit implies risk for both sides, those who provide credit and those who receive it. The risks can be greater or lesser depending on the solvency and efficiency the borrower demonstrates, the lapse of time between the making of the loan and its repayment, and the amount of guarantees provided by the borrower. The risk is greater, naturally, when a loan is made to small firms than when it is made to large businesses, greater still if it is made to a new enterprise, and greatest of all when the guarantees they can offer are meager.

Now, the greater the risk that the person providing the finance incurs, the higher the interest rate they will charge for the loan and the greater the guarantees they will require. For this reason, new enterprises, small and with little equity, have a hard time getting loans and when they do must pay high interest rates for short terms.

In theory, there is no contradiction between external financing through loans and the economic rationality of solidarity economy. But this does not mean there are no problems involved. There are. Because while it is true that the provider of credit runs a risk, it is no less certain that the borrower also is taking a big risk, a risk that rises directly with the interest rate and inversely with the duration of the loan.

An enterprise that obtains a large part of its financial resources and equity through loans from third parties can find itself obliged to operate according to the capitalist logic of profit maximization in order to pay back the money borrowed. In this way the enterprise will stray from the path leading to its objectives of benefiting the workers, the solidarity group, and the community, which are the objectives of an enterprise centered on solidarity.

So what conclusions can we draw about the three forms of obtaining financing on the market?

We can rule out the sale of shares in the enterprise, due to a lack of coherence with our principles and objectives.

We can also exclude the issuance of bonds, for reasons of inefficiency.

We can explore the possibility of obtaining loans if the conditions are reasonable, opportune, and appropriate.

But we have to place this way of obtaining financing in a broader context: in the framework of a general analysis of ways to obtain factors and financing that are reasonable, opportune, and appropriate for a solidarity enterprise. This leads us to look beyond the market, to think less of how capitalist businesses do it and more in terms of ways of operating that match the nature of solidarity economy and may offer solidarity enterprises unique opportunities to assemble the necessary factors.

Alternative Means of Obtaining Factors: the Solidarity Economy Way

Let us return to the problem: the solidarity group has explored the abilities of the members to contribute factors in their possession and the capacity of the group to develop other necessary factors by its own efforts, but still lacks factors. How to obtain them?

Obviously, the factors that members do not have and the group can not create on its own have to be obtained from others, from the people or economic agents who do have them. So it is a question of convincing some of these people or organizations to place factors in their possession at the disposal of the solidarity enterprise we wish to create.

In Unit I we learned that the solidarity economy presents new opportunities that are lacking in the capitalist economy. In the production process, for example, solidarity economy can draw on a special factor of production, the C Factor (solidarity converted into a productive force), a factor that also supplements the other factors present in any enterprise: labor, technology, management, and the material means of production. We will now see that the solidarity economy also offers new ways to obtain the necessary factors of production. Relations with third parties are not limited to transfers based on market exchange. Solidarity economy includes other ways to relate to third parties in order to obtain factors: donations, reciprocity, comensality, and cooperation.

We will now analyze how these relations of solidarity can serve as suitable means for obtaining at least some of the factors our enterprise still requires.

To discover the possibilities it is important to be aware of one essential fact:

Our solidarity group is not alone, nor are we the only people and organizations whose relations are based on solidarity. There is a potential for solidarity in every person, every organization, and every society. The solidarity economy counts on this basic essential fact.

The people, organizations, and societies around us possess factors of production. They are among the “third parties” who we have said might be able to provide our enterprise the factors we need. It is time to see to what extent and in what forms they might permit us to acquire them.

Donations, reciprocity, comensality, and cooperation each have potential and limits, advantages and disadvantages. It is important for us first to understand them theoretically. Later, we will consider them in concrete terms in the exercises and practical activities, putting our theoretical understanding to use in the process of creating the enterprise we desire.

1. Donations2

Donations are transfers of assets – goods, services, or productive factors – that some subjects make to others in order to benefit the latter or to obtain in them some desired effect.

Donations imply two decisions: the donor’s decision to give something, and the recipient or beneficiary’s decision to accept or reject the offer. Both decisions are based on certain objectives and purposes.

The donors have an interest in knowing how the gifts they make will be used so it is important to them to understand the objectives and purposes of the beneficiaries. For the recipients, on the other hand, it is important to know the objectives and purposes of the donors because their intentions are not always good and may not coincide with their own. For example, it may happen that upon receiving a donation that carries certain conditions on its use, the receiving group ends up doing things that they do not want to do, pursuing objectives that do not interest them, in order to satisfy the donor.

It rarely occurs that the donors themselves take the initiative to make a donation. In most cases, the decision of the donors is motivated by the beneficiaries, who present their needs, objectives, ideas, and projects, and ask the donor to support them by making a donation.

This shows that obtaining donations requires an active process, an organized force, the deployment of initiative, creativity, and labor. Donations are not obtained by the presentation of weakness and poverty but by demonstrating capacity, high motivation, and realistic projects. As the Gospel says, “Whoever has will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them.”3 If the solidarity group aspires to obtain certain factors in the form of donations, they will get them not by showing they have nothing and lack everything, buy by demonstrating that they have already achieved much on their own and are seeking a complement, something they still need after having made all the effort that they can to obtain it on their own, individually and as a group.

It is helpful to know that any of the six productive factors can be obtained through a donation. Voluntary labor is a donation of labor power. Technical training and leadership education are a donation of technological and management factors. Organizational support, collaborative assistance4 , recruitment of people into groups and larger organizations, are all donations of the C Factor. Donations of money, or loans that are subsidized or made with generous conditions, are donations of the finance factor.

Of course, in addition to the possibility of soliciting donations from individuals, enterprises, and other entities, the group can turn to organized systems of donations: institutions that make donations in pursuit of social aims, or dedicate themselves to providing micro-enterprises with needed factors of production. These organized donations may come from the public sector, through municipal agencies or offices that provide support for certain activities, granted on the basis of applications. Or they can come from private not for profit, non-governmental foundations that are accustomed to receiving proposals and supporting their realization through various means.

Ethical commitments implied by the receipt of donations

Finally, when we think of potential donations we should keep in mind that the receipt of factors in a spirit of solidarity implies a series of ethical commitments. These surge from the group’s own disposition to solidarity and the framework of solidarity economy in which the donations are made and received.

There are three moral commitments to be made: the commitment to using well and efficiently that which one receives; the moral commitment to give back what one has received, or offer it to others, when the need for that which is donated has been satisfied or the group has reached self-sufficiency, or to “pay it forward” making donations which extend the effect of the donation received, such that more people and/or groups are helped (for example, teaching others what one has learned); and the commitment to respect and honor the agreements one has made with the donor.

Experience teaches us that donations received in a spirit that does not correspond to this ethic of solidarity end up doing more harm than good to the enterprise and the receiving group. What is easily gotten is easily lost, almost always because being casually received it is not valued and not used with efficiency. And, inevitably, failure to meet one’s obligations and use donations wisely reduces the chance of obtaining solidarity donations in the future.

2. Reciprocity and Barter

Another way to obtain factors and integrate them into the enterprise is through reciprocity and barter.

These transfers suppose relations of mutual trust between the solidarity group (or one its members) and people and organizations outside the group. Based on this relationship, the solidarity group and its external counterparts assume commitments, make agreements, or sign contracts, according to which the enterprise receives certain factors to be used productively, without having to pay for them, in return for something that benefits the owner of those factors, whether provided immediately or at a later date. The enterprise can, for example, use a space or part of it, taking responsibility for maintaining it and adding to its value through some improvement or expansion; make use of a machine in exchange for giving the owner part of the product produced with it; make use of labor power that will be recompensed through services, training, products, or some other asset that interests the workers; or receive money in the form of a no interest loan. All of these are forms of reciprocity and barter established on the basis of mutual trust springing from the desire to collaborate with each other in their propositions and projects.

The greater the network of social relations the solidarity group and its members have developed, the more opportunities for reciprocity they will find. Barter, commitments to future compensation, mutual aid agreements, reciprocal benefit agreements, all constitute forms of solidarity that extend beyond the immediate solidarity group, and can be understood as broader expressions of the C Factor.

3. Comensality

Another mode of solidarity in the procurement or utilization of productive factors is comensality that is the shared use of factors by various subjects. Each “sharer” uses the factors in accordance with their needs and requirements and contributes to its sustainability to the degree they can. There are material goods – spaces, machinery, equipment, etc. – that can be used by various enterprises: labor power that can transfer temporarily from one to the other to support them in moments of greater need; technology and knowledge that can be shared and developed jointly; aspects of management and administration that can be used jointly by various economic units; capacity for credit that can be multiplied through systems of shared security and guarantees and operate as rotating funds.

Solidarity enterprises have an advantage here. Unlike capitalist businesses which compete against each other in the same market and therefore do their best to avoid comensality in the employment of productive factors; solidarity economy enterprises do not have to assume the full costs of factors of production individually. They can take advantage of numerous opportunities to share factors and benefit from their joint use, resulting in more extensive productivity. Naturally, comensality supposes the existence of multiple and diverse solidarity enterprises capable of relating to each other and establishing forms of mutual collaboration.5

4. Cooperation

Cooperation among solidarity enterprises and organizations for the procurement of needed factors is similar to comensality with the difference that the rights of use of the factors that are available on a cooperative basis are proportional to the contributions that each cooperator has made to gather them. Cooperation supposes a greater degree of formalization and more rigorous accounting in operations.

The most wide-spread form of cooperation in the procurement of factors is that which gives rise to savings and loan cooperatives or credit unions, in which the finance factor is made up of members’ dues and savings, with the members acquiring rights to obtain loans in proportion to the contributions and savings made. But cooperation can also occur with respect to the other factors of production, through modes of inter-cooperation in which various enterprises make complementary contributions of factors, putting them at the disposal of member enterprises in quantities they may require. For example, various solidarity enterprises can set up an accounting and bookkeeping cooperative that all of the enterprises use; or develop computer programs and systems for management and administration that are useful to all the enterprises, or serve as common technology; they can even think of creating cooperative job banks which permit some degree of flexibility in deployment of labor power in order to satisfy seasonal variations in labor needs, or other types of cycles.

How to obtain financing that is rational, appropriate, and efficient for a coherent solidarity enterprise

To create its enterprise, the solidarity group will explore each of the alternative ways to obtain productive factors from third parties: private and public donations, reciprocal transfers, comensality, and cooperation. Adding all of the factors obtained through solidarity transfers to those contributed by members and those developed by the solidarity group itself, the need to buy factors is considerably reduced. So, less money will be needed for both the creation and operation of the enterprise than would be the case if the same enterprise were run on the capitalist model. Going back to a concept we introduced in Unit III, we can express this fact this way: in the process of creation of a solidarity enterprise, the C Factor and labor power can serve as substitutes for the finance factor.

This does not mean that one can do without money and financing when procuring the factors not otherwise available or when conducting commercial activities. Money is needed to create and operate an enterprise, including a solidarity enterprise that is largely capable of doing without it, if only for assuring certain future payments. For this reason it is necessary to examine more deeply how the group can assure the availability of financing in the necessary quantities and under terms that are reasonable, appropriate, and efficient.

First of all we need to ask, “Why is financing the most scarce of the factors of production, and usually the most difficult to obtain? Why is it more difficult for each of us to offer this factor to the enterprise that we wish to create, than any other factor? Why is it easier for us to freely offer an hour or day of labor than to make a gift of the quantity of money that we would charge for that same day or hour of paid work? What makes the finance factor special, different from the others?”

We start from a fact known to all: one characteristic of money is that it is self-reproducing and grows with the passage of time. If we have money, we have only to deposit it in a bank or financial institution in order to earn interest for the time it is deposited. And due to compound interest the longer the money is deposited the greater the gain will be, because the sum to which the interest rate is applied will continue growing.

How are banks able to meet their commitment to the depositor to return the money they borrowed, with interest? They do it by lending that money to other people who are willing to pay interest for the time during which they borrow the money, which they likewise return in full. Because the interest the banks charge is greater than the interest they pay depositors they can meet their commitment to the depositors and make a profit on top.

But why? Why does money earn interest simply by being placed with a bank or lent to an enterprise or individual? What is that quantity of money we call “interest” actually compensating? We have often heard that interest is compensation to the lender or depositor for the risk they are taking by putting their money in others’ hands: the risk that the money will not be returned or might be lost. One takes a risk by putting money in the bank and the bank takes a risk putting money in the hands of borrowers. This is all true, but there is another truth without which we still can not comprehend how finance operates and why it is so expensive.

The fact is that in order to have money to deposit in a bank or lend to someone else, it is necessary to have previously saved it, that is to have decided not to spend it, sacrificing some present consumption and reserving the money for future use. Only if one does not spend it will one be able to have money that earns interest and grows over time. Inversely, whoever receives a loan does so having decided to make some expenditure or investment in advance, if you will, having chosen to buy something now with money that they do not have but hope to receive in the future. One sacrifices now in order to have in the future, the other benefits now from the sacrifice of another, and makes a commitment to pay in the future. One way or the other, someone is earning interest and someone is paying. The person who sacrifices consumption here and now is rewarded with interest, and the person who makes use of the money in anticipation of earning it, is punished by having to pay interest.

The two are related: loaning to someone who has savings (or equity, which in this case amounts to the same thing) is much less risky that loaning to someone who is in debt. Loaning to someone whose economic behavior is prudent and austere, someone able to sacrifice current consumption and save, implies less risk than loaning to someone who spends money before they have earned it.

Taking these two facts into account, it is clear why financing is hard to come by, and why it is so difficult and costly to get a loan especially at a reasonably low rate of interest. But the most important thing is we now know what to do to obtain financing that is rational, opportune, and appropriate.

To sum up: in order to obtain loans it is necessary to be trustworthy, credible.

Nobody is going to put their money into an enterprise that does not guarantee that it will fulfill its commitments. Anyone who does so is taking a big risk and will demand the highest of interest rates and excessive guarantees. On the other hand, any trustworthy enterprise or person who has a history and behavior that show they know how to meet their obligations will not have to go looking for credit. Those offering financing will look for them and offer money at a low interest rate under favorable conditions.

But how can we make ourselves credible? How can we gain the trust of those who provide financing? How can we obtain the financing that we need in order to create an enterprise if those who offer loans require a track record that proves the trustworthiness of the enterprise to which they will provide credit and lend money?

It is not about having a good pitch, not a question of luck, nor of having good contacts. Luck, contacts, the power of persuasion can be helpful but the key is something else. To be believed, to have credibility in the eyes of others, we have to believe in ourselves and demonstrate that in our actions. How do we do that? To answer this question, it is enough to ask oneself the following: would we put our money in an enterprise whose owners have not invested in it? No. How can you believe in an enterprise in which its own organizers do not believe? How can we hope that others will trust our enterprise if we don’t trust it ourselves?

We demonstrate our faith and trust in the enterprise we wish to create first of all by investing: our time, our labor, our knowledge, our relationships, and… our money. When we have invested all of this in our own enterprise, thus demonstrating in concrete terms the faith we have in the project that unites us, we will have little need for external financing and will be able to find it – in the form of loans, donations, cooperation agreements, etc. What we have contributed and placed in common becomes our best calling card and if we believe enough in our project we will even be ready to use our own assets as collateral for external financing, if it is demanded of us.

Questions for Review and Discussion #5

The following questions should be answered individually, in writing. Each participant will later share their answers during the group work, allowing for evaluation and correction of the answers by comparing them with the answers of other members and ensuing discussion.

-

What are the three ways enterprises normally procure financing on the market from third parties?

-

Can solidarity enterprises issue shares of stock without losing their coherence as solidarity organizations? When does the issuance of shares contradict the rationality of the solidarity economy, and under what conditions does it not?

-

Why is the issuance and sale of bonds not appropriate for solidarity enterprises?

-

Under what conditions is it rational and convenient for a solidarity enterprise to seek financial credit? What problems, risks, and limitations does this form of financing pose?

-

What are the modes of external financing appropriate to the solidarity economy? What is the basic fact on which the possibility of obtaining solidarity financing is based?

-

In the case of a solidarity group, why are the following necessary in order to obtain donations: an active approach, an organized effort, and initiative, creativity, and labor? How can we relate this to the saying, “to those who have, much is given”?

-

What are the ethical commitments involved when a solidarity enterprise receives donations?

-

Give some examples of how a solidarity enterprise can procure factors from external sources through relations of reciprocity, barter, and comensality.

-

In what forms can the enterprise obtain factors through cooperative relations? Do credit unions provide a valid way to obtain financing for a solidarity enterprise?

-

Why is financing the most difficult factor to obtain?

-

What is the most important thing a solidarity group must do in order to obtain the financing it needs from third parties?

INDIVIDUAL TASK #5

To be done after the ninth session

-

Study the Glossary at the end of Unit V.

-

Answer the “Questions for Review and Discussion #5” in writing in your notebook.

-

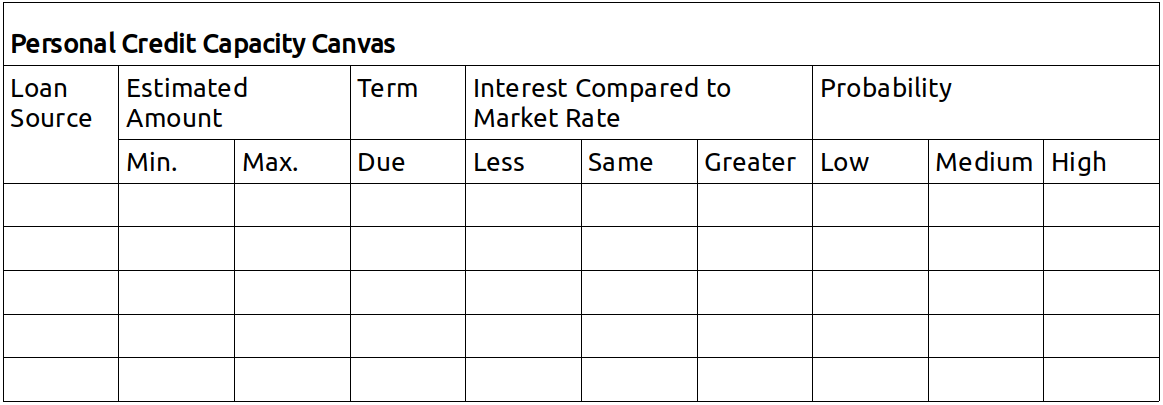

Explore your personal “credit capacity” in relation to the solidarity enterprise your group is proposing.

Exploring Your Credit Capacity

This activity consists of answering two questions:

1) How much money can I get people to lend me on behalf of the enterprise our solidarity group is creating? For what length of time and at what interest rate?

2) If I can obtain these loans, would I be willing to put the money into our enterprise even if it means taking on personal debt and assuming the risk of losing the money I borrowed?

The objective of this task is not to have individuals or the enterprise go into debt, but to become fully aware of the significance of borrowing money and get a sense of how much risk the members of the solidarity group, as future members of the enterprise, are willing to take to make it a success. We will also explore the possibility of procuring outside financing through borrowing done by the enterprise itself, that is to say, its members.

All of this is very important because a newly formed enterprise has little chance of obtaining external financing through loans. Normally, loans are made to enterprises that have a track record that demonstrates their ability to pay the money back out of their operating profits. When an enterprise is created, its organizers must think that in addition to the capital they may personally invest in it, they may also have to make use to at least some degree of their own capacity to borrow money.

If the members of the solidarity group are really convinced of the viability of the enterprise they want to create and believe it will produce the desired results, that will be seen in their willingness to take risks in order to make it happen. Who should assume the risk, if not them? How could members expect others to take a risk on their enterprise if they are not ready to take a risk themselves?

When doing this individual task we should start with the conviction that each of us has some capacity to borrow money. How much capacity you have depends on many things: reputation, credibility, income, personal equity, and social relations. Every member can obtain loans from the people they know, starting with family members, friends, and acquaintances, groups to which we belong, enterprises and commercial and financial institutions of which we are clients. These sources of credit may lend certain quantities, for specific lengths of time, at an interest rate that is lower, the same, or higher than that offered by commercial banks. The point is to explore all of these possibilities.

We are not yet asking for loans in reality, but asking each member to explore and get to know their own capacity for obtaining credit or loans. There can be many reasons why a person does not want to ask others for credit or loans; and there may be reasons why people are reluctant to transfer the money they have borrowed to the enterprise. All of this will need to be considered by each member when the time comes to make decisions. For now, we are just exploring the possibilities.

Each member of the solidarity group should complete the chart below. The information should be based on the member’s personal assessment, thinking of who they might go to for a loan, how much to ask for, and on what conditions. They should also think about the probability that the person or organization will say, “yes.” Is the probability high? Medium? Low? It is not necessary to write people’s names in the chart. It is enough to indicate if the person is a family member, friend, organization, bank, etc. But be careful: the point is not how much money these sources have, how rich they are, or how much they are able to loan you, but how credible and trustworthy you are in their eyes. This is the key to the exercise.

Session 10

Plan

-

Gather, welcome, thematic game, form a circle, choose a moderator for the meeting.

-

Reading and commentary on the answers to Questions for Review and Discussion #5. (If the group is large, each participant will read only one or two responses.)

-

Exercise #9: Exploring Possible Donations.

-

Break, snack.

-

Exercise #10: Exploring Opportunities for Reciprocity, Barter, comensality, and Cooperation with Third Parties.

-

Assignment of Individual Task.

-

Reading and Organization of Jornada #5: “Costs and Financing Budget.”

Exercise #9

Exploring Possible Donations

Explanation

The purpose of this group exercise is to examine the possible sources of donations the solidarity group might be able to obtain in order to carry out its project of creating a solidarity enterprise. In many countries there are non-governmental organizations that fund initiatives of self-help organization and make donations on the basis of proposals that groups submit to them. Some public agencies – municipal, state, or federal – also have resources that can be used to support initiatives that create employment or address certain social problems. In addition to these institutional sources of donations, one should consider the possibility of securing private donations through enterprises, organizations, or people who might have a reason to support this solidarity enterprise project and be willing to collaborate by making a donation.

In this exercise the idea is to find and share information and ideas, and analyze in realistic terms the value of contacting particular potential sources of donations for a solidarity enterprise, sources that the group could at some point approach with a request for support.

The Flow

The flow of this exercise depends on whether the group has already established contact with institutions or organizations that make donations, whether the criteria applied by the funders and the requirements the group must meet are already known, and if there is already some kind of relation to the potential funder. Depending on the answers to those questions, the exercise can be carried out with more or less realism and specificity. In any case the steps to be taken are the same:

-

Sharing information. Taking turns, group members share what they know about possible sources of donations, the conditions on which they are made, the requirements, if the group has contacts or relationships or possible ways to approach the potential funders.

-

Reflection and analysis. The group reflects on the the appropriateness, viability, and necessity of seeking donations from these sources in order to finance the creation of the enterprise.

-

Action planning. The group discusses actions they might take that would increase the possibility of obtaining donations on the most favorable terms. This could imply searching for information, establishing relations and contacts, preparation of proposals to be submitted to funders, etc.

Exercise #10

Exploring Opportunities for Reciprocity, Barter, Comensality, and Cooperation with Third Parties

Explanation

Without a doubt the members of the solidarity group are surrounded by other people, social organizations, associations, NGOs, public and private institutions of various types, etc., with which their nascent solidarity enterprise can establish relations of reciprocity, barter, comensality, and cooperation, for mutual benefit and utility.

Identifying these people and organized subjects, discovering what they can contribute to the solidarity enterprise, and, simultaneously, analyzing what the solidarity group and the enterprise we are creating can contribute to them, is a process of exploration of possible sources of resources that many groups fail to seek out or approach appropriately, simply because they are not aware of their existence. The are always more factors and resources surrounding the enterprise, accessible to the group, than we imagine. Here the slogan fits: “only the person who strongly desires something will identify the necessary means to make it happen.” Only when the project is clear does one begin to discover the means to make it a reality.

The Flow

In this exercise there are three aspects to consider:

-

-

Possible counterparts in the area, people and organizations with which you might be able to establish relations of reciprocity, barter, comensality, and cooperation.

-

What these counterparts could contribute to your solidarity enterprise. In order to avoid missing any possibility it is best to go through each of the six productive factors.

-

What your solidarity group and the enterprise you are creating could contribute to your counterparts. Go through each of the six factors in the same way.

-

For each organization or subject, examine ways in which mutual support could be established: reciprocity, barter, comensality, and cooperation.

In this exercise you use a canvas and cards of four different colors, arranged in four columns:

-

-

Cards of the first color are for writing the identities of possible counterparts.

-

The second color is for noting the possible factors that each counterpart could contribute to the group.

-

The third color is for contributions that the solidarity group could make to each counterpart.

-

Finally, the fourth color is for noting the types of relations (reciprocity, barter, comensality, cooperation) through which mutual collaboration can be organized.

-

Jornada #5

“Cost Budget and Financing Plan”

What is this practical activity about?

The objective of this Jornada is to calculate the financial needs implied by the creation of the enterprise and its initial operations, that is, first to make a Cost Budget for the project and then to determine the ways in which the necessary finances will be procured and integrated into the project, i.e. to make a Financing Plan. The Jornada concludes with organizing the group so as to merit the required finances.

Which aspects should be taken into account when budgeting for financial needs?

We have seen that before seeking funds and other factors of production outside of the solidarity group, it is essential to explore in depth all that the group members can contribute and the group can create for itself. The more of the necessary factors the group and its members are able to generate, the less will be the enterprise’s financial need. Once all the internal contributions have been considered, one should consider the factors that can be obtained without money through solidarity relationships established by the enterprise: donations, barter, reciprocity, comensality, and cooperation. Only after having specified everything that can be obtained without incurring financial costs should the group estimate and calculate the amount of money from external sources that will be needed, that is, prepare a Costs and Financing Budget.

When making estimates and calculations, the group should consider all the needed factors but keep focused on the essential points. The budget does not need to include items which could be left out without affecting the operation of the enterprise and its productive, commercial, and administrative functions. In any enterprise there are many elements that may be useful but are not indispensable, at least at the beginning, and for a while. The moment will come to invest in them, according to the possibilities that the enterprise creates as a result of generating surplus.

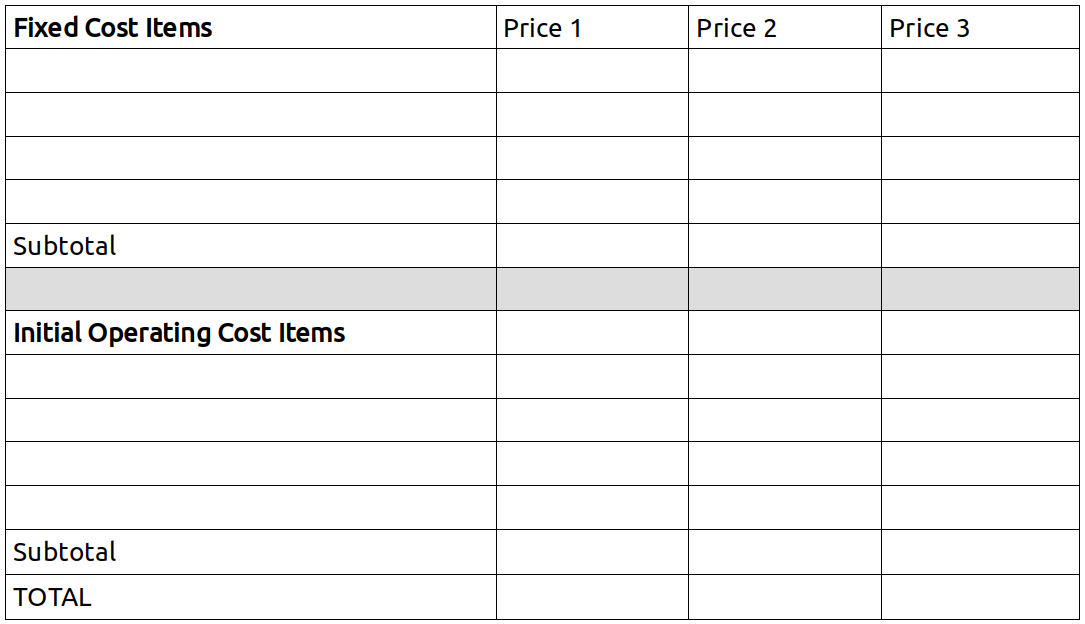

When elaborating the Cost Budget, the following aspects should be distinguished and taken into account:

a) Costs of investing in fixed or durable assets (equipment, machinery, etc.),

b) Operating costs for the establishment and initial phase of operation of the enterprise. (Inputs and raw materials, rent for a workplace/store, advertising, payments or anticipated earnings for labor, cash on hand, etc.) The amount of time for which you should budget is determined by the length of time during which you will be waiting for income from sales. In effect, the budget to be elaborated in this Jornada is incomplete, limited to calculating the costs of creation, establishment, and initial operations of the enterprise, because our goal right now is to identify only the amount of initial financing required, before the enterprise begins to generate income.

Once the budget has been prepared, the next step is to analyze and choose the forms by which to obtain the necessary financing: contributions from members? Group activities to generate income? Donations from third parties? Grants? Loans?

Finally, the solidarity group should determine how to prove itself worthy of the trust and belief of the potential external funders, how to motivate and convince them to contribute (in whatever form, as donation, grant, or loan) the finances that the group cannot otherwise obtain.

What are the activities to be done in this Jornada?

There are four steps:

-

-

Preparation and planning.

-

Doing the assigned individual task.

-

A day (Jornada) of group work.

-

Carrying out the activities decided upon during the day of group work.

-

How to prepare and organize the Jornada

Just as in previous Jornadas the preparation and organization is done in the previous Session (#10), where the explanation is read, individual tasks are assigned, and the day of group work is organized following the instructions given below. As the group has done several Jornadas already and is capable of proceeding efficiently, they will know how to carry out this one, which is more complex than the others, with a variety of preliminary activities to be done individually and in groups, and which imply the performance of tasks that will be decided upon in the course of the Jornada.

In the preparation meeting, the group should have on hand the results of Jornadas 3 (“The Theorem”) and 4 (“Deciding to Contribute Factors”). Using the information gathered in those activities the group should be able to develop a list of the elements needed to create an enterprise that the group does not have and can not create on its own. This list of “missing factors” is the basis for doing the individual and group preparatory tasks.

What are the preparatory tasks? (group and individual)

Each member of the group should come to the Jornada with all the necessary information regarding two elements:

a) The prices at which the missing factors can be purchased on the market, whether as an initial investment (tools, machinery, equipment, etc.) or as inputs to be used in the initial operation of the enterprise (locale, raw material, supplies, production costs, publicity, payment for work by people outside the group, consulting, etc.).

Based on this, the group should assign specific members, individually or in teams of two or three, to study the market and ask various providers for “quotes” (prices and payment terms). Getting quotes is an activity that the enterprise will do regularly and members should learn how to do it in the right way, in order to obtain the best possible prices and terms. The creators of any enterprise need to learn how to negotiate prices, which requires a kind of apprenticeship in which nothing is better than the experience that is shared peer to peer. In any case, there will be various quotes for all of the elements that need to be purchased on the market, never just one, and the variations found in the market can be significant.

In order to get the most from these tasks, the elements for which quotes are needed should be carefully noted by the group members who take responsibility for them.

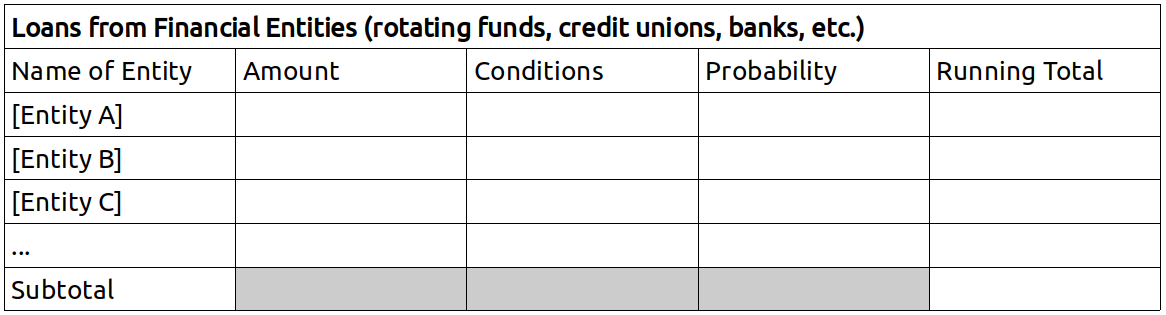

b) Interest rates, terms, and conditions that banks, credit unions, rotating funds, and other financial entities and institutions, place on loans that they offer to individuals and to micro-enterprises or solidarity enterprises (e.g. cooperatives).

What should members bring to the Jornada?

Each person or team will bring the information they have obtained in their research about quotes and loans and prepared to share with the group.

-

The group symbol, logo design, and business idea.

-

All the materials from Exercises 9 and 10.

-

All the materials and information from Jornadas 3 (“The Theorem”) and 4 (“Deciding to Contribute Factors”).

-

A flipchart.

-

A large blackboard or other board.

-

Plenty of index cards (10cm x 20cm) in six colors.

-

Updated account information (personal and group).

How should the Jornada be done, what is the plan for the day of group work?

This Jornada is essentially a work session that can be done in about four hours, though the group may decide to add other activities that they think would be good to include.

The Jornada follows this plan:

-

Gathering, welcome, thematic game. Installation of the group symbol in an appropriate place. Selection of a moderator for the meeting, as well as a “canvas manager” (person who manages the canvas used in the activities), and a note-taker.

-

Set up the materials from Exercises 9 and 10, as well as Jornadas 3 and 4.

-

Preparation of the canvas, using this layout:

-

COST BUDGET

-

Activity 1. Calculating the Cost Budget.

-

Break and Snacks

-

Activity 2. Defining Sources of Financing.

-

Activity 3. Organizing the Group so that it Merits Financing.

Activity 1: Calculating the Cost Budget

In this activity members prepare a Cost Budget that includes the costs involved in the creation of the enterprise, estimating the costs of all the elements that it will be necessary for the group to buy. To prepare this budget, the solidarity group will identify all the necessary elements that are not provided by members, created by the group, or obtained through solidarity means (donation, reciprocity, barter, etc.) using information from previous activities, exercises, and Jornadas. (In some cases a needed element can be created or produced by the group itself but at some expense. Those costs would be included in the budget.)

In this activity the canvas is used for recording information (by posting index cards) in the following order:

First, all the foreseeable items that will cost money should be noted. This information should be placed on the canvas in the corresponding table:

Fixed Cost Items are equipment, machinery, and other durable implements that will be used in the enterprise for a prolonged period.

Initial Operating Costs are raw materials and inputs, locale, initial payments for labor, cash on hand, etc., items that are indispensable in the initial period when the enterprise is just starting up. These are costs that should be covered ahead of time, knowing that the enterprise will not generate sufficient revenue to finance them until sales have reached a certain level.

Later, for each item, the corresponding price quotes should be noted, based on the research done in preparation for the Jornada. Based on data collected by individuals and teams for prices, quality, and conditions, the group chooses the best option and the price in the corresponding column is circled.

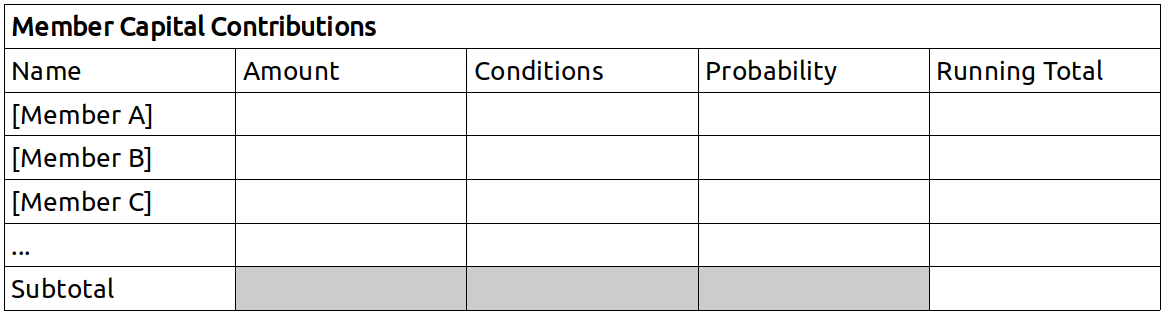

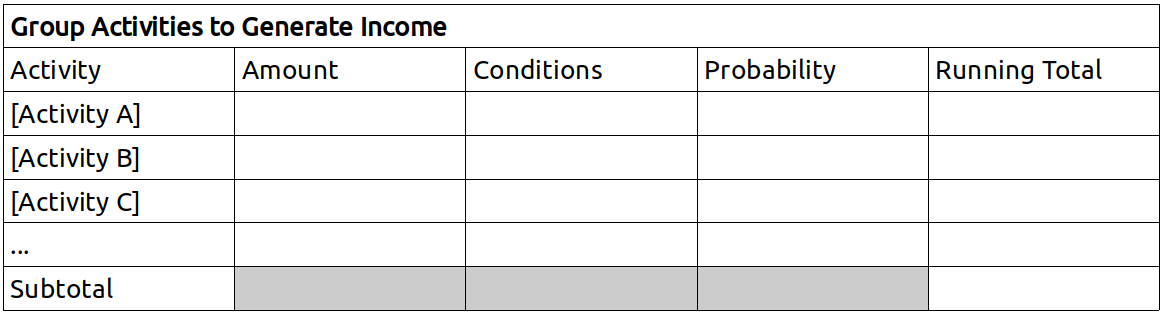

Activity 2: Defining Sources of Financing

Once the needs for external financing have been identified, as well as the amount of money needed by the enterprise during its startup and initial phase (that is, until it begins to generate enough revenue to become self-financing), the group should analyze how it might obtain the necessary finances.

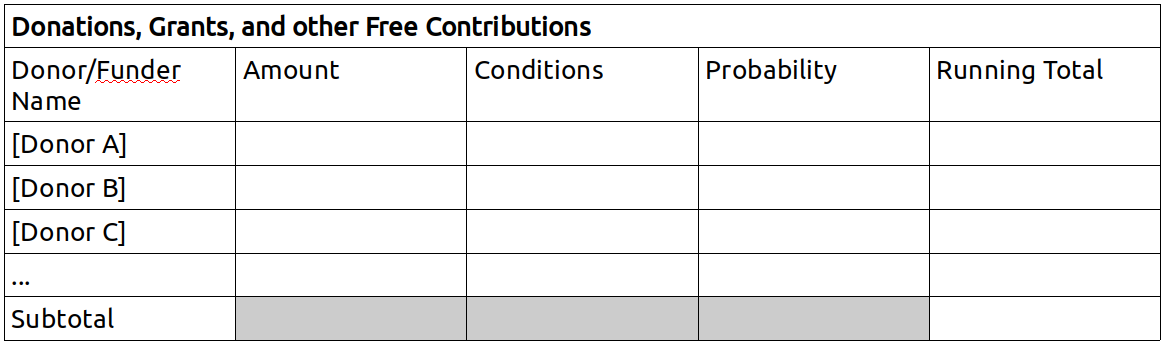

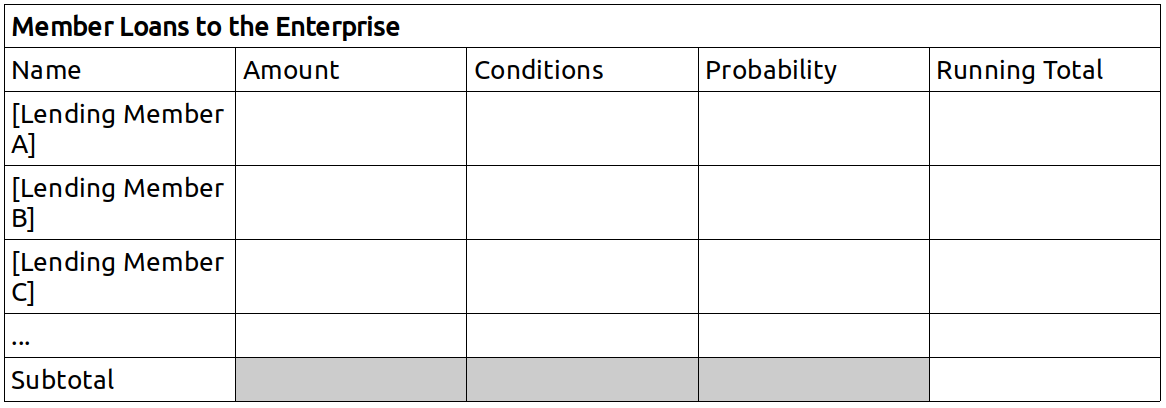

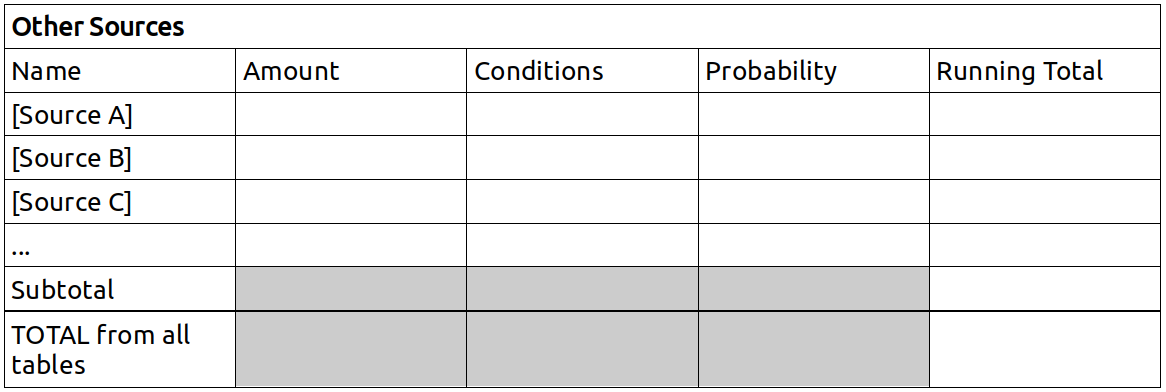

Using the following tables for this activity, record the information on a flip chart or a second canvas. The goals is to identify possible sources of financing.

FINANCING PLAN6

The group listens to the information provided by fellow group members, based on the information obtained in the previous exercises and activities, and, if it is accepted, it is added to the tables.

The amount to be noted is that which members believe it is possible to obtain from the source, and that the group is prepared to accept.

The conditions are things like the interest rate, the term of a loan, or other conditions.

The probability refers to the likelihood that the contribution can be obtained, according to the assessment of the member(s) who did the research, or the group as a whole. It can be expressed as a percentage.

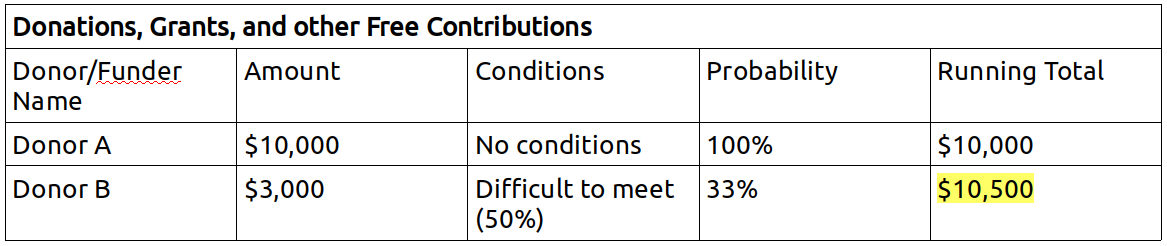

In the column titled “running total” the group keeps a running tally of the amounts they can obtain from each source, adding the results of each row. Note: it is not simply the total of the amounts in the second column, but each amount adjusted to reflect the conditions and probability scores. For example, if under Activity 1, in the Group Activities table above, the amount is $1,000 but the probability of obtaining it is 50%, only $500 is added to the running total. If, in addition, there are conditions that make it difficult to obtain funds from the given source, the members make a subjective estimate of the degree of difficulty, and further reduce the amount. Let’s take another example:

Only $500 is added to the running total in the second row because there is only a 50% chance the enterprise can meet the conditions (reducing the amount to $1,500) and the probability of getting the donation, even if the group can meet the conditions, is only 33% ($1,500 x 33% ≈ $500).

The logic of keeping a running total is that some probabilities balance out others.

The idea is to have a realistic appreciation of the possibility of obtaining the finances necessary for the creation of the enterprise, following the order in which it is best to seek money from different sources: first from member contributions, then from group activity, then from donations, and so on.

Activity 3: Organizing the Group so that it Merits Financing

In Activity 1 the group could see how much financing is needed in order to create and begin operating the enterprise. Activity 2 asks the group to identify the ways the funds might be obtained. Now it is time to think about what it means to “merit the financing” the group hopes to obtain. How to make the group trustworthy, credible, capable of proving themselves reliable to those who would trust the group with their resources. If the sum of the subtotals in each table is not sufficient to meet the needs, the group will need to do more work to show itself “deserving” of support than if the sum is greater than the total amount needed. In any case, in this activity, the group should apply the criteria studied in Reading 5, and organize itself accordingly such that the group can proceed rapidly once it has completed the Readings, Activities, Exercises, and Jornadas, and is prepared to assume the commitments implied in accepting financing.

We should note that we called this activity “Organizing the Group so that it Merits Financing” and not “Finding Financing” because the group is not yet ready for the final decision to create an enterprise: the group is not yet adequately organized and still needs a Business Plan. These will demonstrate the viability of the enterprise.

GLOSSARY

Bankruptcy

The failure of an enterprise caused by its insolvency or incapacity to meet its obligations to repay loans, bonds, or other financial debts.

Barter

A relation of exchange between two subjects who exchange goods or services of the same estimated value, without use of money. The goods or services are directly exchanged without a calculation of monetary price, but simply on the basis of mutual satisfaction, which implies an agreement about what is to be offered and received by each party.

Bonds (issuance of bonds)

Bonds are documents issued by enterprises that commit the enterprise to paying on a specified future date (three years, five years, etc.) a certain quantity of money, which is stipulated in the documents. Bonds are purchased by investors at a discounted price, such that their purchase represents a gain for the investor (a future profit) that can be calculated as the equivalent of interest on the money spent when purchasing the bond.

Comensality (or sharing)

A form of economic relationship between various subjects who are part of a group, community, or organization in which goods and services are contributed by each according to their means and transferred to others according to their needs. It is most often seen in families or communities where economic relations are determined by the varying capacities and needs of the members.7

Compound Interest

The increment in a given sum of money when the interest earned in a certain period is added to the original amount of money saved (or borrowed), and, in the following period, the established interest rate is applied to the sum of the initial money and the interest from the first period. Over the course of successive periods of time, the amount saved (or owed) increases exponentially.

Cooperation

Cooperation is an economic relation between subjects who are part of a collectively managed association or organization to which members pay dues and make contributions in the form of money, work, or other factors, generating a surplus or profits that are distributed among the members according to the contributions each has made.8

Corporation

A corporation is an economic unit in which ownership is divided into shares of stock. The liability of the share holders is limited to the value of the shares they hold; their personal assets being protected.

Financial Entities

Banks, Finance Companies, Credit Unions, Cooperative Banks, and all other institutions that play an intermediating role, collecting savings and providing loans, connecting the supply and demand of money in the market.

Guarantees

Commitments that financial entities require of those who seek credit, with which the former seek to ensure that the latter can meet their promises to pay. There are various types of guarantees such as mortgages on property and real estate, collateral in the form of furniture, documents like checks and promissory notes, and other economic assets with which the creditors be compensated in the event that the borrower can not pay the principal and interest to which the parties agreed.

Interest Rate

We commonly say that the “interest rate” represents the value of money, that is, the price you have to pay to borrow money from others on the market. The interest rate represents a percentage of the amount of money transferred. The “deposit interest rate” refers to the interest paid by the financial entity to the depositor, and the “loan interest rate” refers to the interest the financial entity charges a borrower.

Non-Profit Organizations

Non-profit organizations are economic units that organize individuals or collectives to support some process, resolve certain problems, or contribute to the satisfaction of specific social needs without the expectation of making a profit or economic gain from their activities. These economic units are dedicated to social ends and not to the personal benefit of their organizers and owners.

Reciprocity

Reciprocity is a transfer of goods or services between two subjects (individuals or collectives) in a particular moment or period of time, without calculating the price of the goods or services transferred, but with the commitment that the value received will be compensated at some point. These transfers are only possible on the basis of mutual trust between the two parties.

Shares (of stock)

Shares are units of value representing the capital invested in an enterprise that is organized as a corporation. Shares represent first of all a quantity of money invested, which is represented by the “face” (or nominal) value. But shares also represent a percentage of the total equity of the enterprise which can rise or fall in value as a result of profits, losses, reinvestment, debt, etc., leading to a rise or fall in the value of the shares. The “book value” of shares is determined by the ratio of equity to the number of shares. Stocks are traded on the market, where they acquire a “share price” based on future expectations of the enterprise’s profits or losses and supply and demand for the stock. This is the market value of the shares, the price at which they trade on the stock market.

Transfer of Assets

Any movement of assets with economic value from one person or social subject to another. It can take the form of donations, exchanges, taxes, allocations, subsidies, etc.

EVALUATION OF UNIT V

This evaluation is to be done both individually and as a group.

Individual Evaluation

Each participant should answer the following questions in their notebook:

A. Circle the answer that best matches your experience.

-

My understanding of the contents covered in this Unit is:

Weak – Good – Excellent

-

My performance of the individual assignments in this Unit was:

Weak – Satisfactory – Very good

-

I consider my contributions to the group exercises to be:

Poor – Adequate – Outstanding

-

My participation in the organization and execution of the practical activity (Jornada) was:

Passive – Relatively active – Very active

-

I think my overall contribution to the group was:

Very little – Could have been better – Ample

B. Reflect on the following questions and summarize your answers in writing.

-

Was the analysis I did of my personal capacity to obtain credit for our solidarity enterprise rigorous enough? Did it help me discover and appreciate my economic credibility among those who know me? What was the effect of this personal assessment on my self-esteem?

-

How much faith do I have in the solidarity enterprise in which I am participating? Am I giving it all the credit that I think it deserves, or do I still have doubts, suspicions, worries? Is it possible that I am expecting a lot from the group and the project but still not fully committed to making it happen?

-

Do the forecasts we made as a group with respect to the possibilities of securing donations and obtaining factors for the enterprise through other relations of solidarity, seem realistic?

Group Evaluation (to be done in the next session)

Seated in a circle, the whole group discusses the following questions.

-

Have we created a good Cost Budget for the enterprise we hope to create? With a little distance from it already, do we think we got carried away by our enthusiasm, or, on the contrary, were we too pessimistic?

-

Were we realistic in our projection of our ability to secure financial resources from ourselves, the solidarity sector, and the financial market?

-

Based on the Cost Budget and Financing Plan, are we really ready to start our project, or do we need to rethink it, reducing our plans to match our capacity, or, on the contrary, expanding them to take better advantage of all the capacities and resources we might be able to obtain?

- 1Razeto does not discuss venture capital as such, but the analysis of loans and the logic of solidarity economy clearly applies. [-MN]

- 2See Chapter 3 of Razeto’s Solidarity Economy Roads for a detailed analysis of the economy of donations. https://geo.coop/story/solidarity-economy-roads-chapter-3 [MN]

- 3Matthew 13, New International Version [MN]

- 4Literally “accompanying” accompañamiento. For more on this concept, see Staughton Lynd’s Accompanying: Pathways to Social Change PM Press 2012. [MN]

- 5Comensality is similar to the practice of commoning, which implies a larger strategic framework for social-economic change, akin to solidarity economy. See David Bollier’s “Commoning as a Transformative Social Paradigm.” http://www.bollier.org/blog/commoning-transformative-social-paradigm [-MN]

- 6In these tables, write the names of members, activities, donors, etc. Clearly, in many cases there will be more than three items. [- MN]

- 7The concept was made famous by Marx in his “Critique of the Gotha Program,” though he did not use the term. “Comensality” is not widely used in English, where it usually refers to the act of eating together or sharing a meal. In biology, it is a form of symbiosis in which one organism benefits without harming the other. [– MN]

- 8The International Cooperative Association’s seven cooperative principles are a common reference point: Open and Voluntary Membership; Democratic Member Control; Members’ Economic Participation; Autonomy and Independence; Education, Training and Information; Cooperation among Cooperatives; and Concern for Community. Cooperatives sometimes add/change principles, for example the principles of the Mondragon Corporation include “Sovereignty of Labor” and “The Instrumental and Subordinated Role of Capital.” [– MN]

Citations

Luis Razeto Migliaro (2020). How to Create a Solidarity Enterprise: Unit V. Grassroots Economic Organizing (GEO). https://geo.coop/articles/how-create-solidarity-enterprise-unit-v

Add new comment